tax return unemployment covid

The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person. The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable amount of unemployment compensation and tax.

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan Act enacted on March 11 2021 allows you to exclude from income up to 10200 of.

. This year has certainly added to. There are no taxes on unemployment benefits in Virginia. Across the nation millions of Americans lost their jobs in the wake of the COVID-19 pandemic and as a result claimed unemployment benefits.

COVID Tax Tip 2022-16 IRS Free File now accepting 2021 tax returns. COVID Tax Tip 2021-46 April 8 2021 Normally any unemployment compensation someone receives is taxable. This threshold applies to all filing statuses and it doesnt double to.

COVID Tax Tip 2022-11. The fact is unemployment compensation doesnt come tax free. Millions of people who overpaid taxes on their 2020 unemployment benefits will start getting.

This story is part of Taxes 2022 CNETs coverage of the best tax software and everything else you need to get your return filed quickly accurately and on-time. But you may still qualify for unemployment benefits. A key update in the bill which the house passed Wednesday is a provision that waives taxes on the first 10200 in unemployment insurance income for individuals who have.

COVID-19 Unemployment Benefits. You may have to attach it to your state county or local income tax return. Both the Qualified Sick Leave and Qualified Family Leave tax credits have been made effective as of April 1 2020 and end March 31 2021 under the COVID-related Tax Relief Act of 2020.

IRS sends out 4 million refunds for 2020 unemployment benefit overpayments. President Joe Biden signed the pandemic relief law in. People who become unemployed for the first time are often shocked to learn that they must report their unemployment benefits more than 10200 on.

To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000. How COVID-19 has affected unemployment benefits. Taxpayers may receive a refund for taxes paid on 2020 unemployment.

If you received unemployment benefits in 2020 a tax refund may be on its way to you. If so keep a copy for yourself. That means they can claim the additional 1500 on their tax.

For eligible taxpayers this could result in a refund a reduced balance due or no change to tax. Long a CPA and one of the AICPAs Consumer Financial Education Advocates. Under longstanding New York State law unemployment compensation is subject to tax which means you should report the full amount of unemployment compensation on your New York.

COVID-19 extended unemployment benefits from the federal government have ended. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. The American Rescue Plan extended.

State Income Tax Range. Unemployment benefits are always taxed on your federal return said Kelley C. From stimulus checks to unemployment insurance heres how 2021 Covid-19 relief can affect your 2022 finances.

The legislation excludes only 2020 unemployment benefits from. However a recent law change allows some recipients to not pay. Its taxable income even if it doesnt feel like you earned.

State Taxes on Unemployment Benefits. You could end up with a tax bill and possibly penalties and interest when you file your tax returns in 2021. If you applied for unemployment benefits the CARES Act allows for 13 additional weeks of benefits until December 26 plus an extra 600 a week through July 31 along with the standard.

The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020. COVID Tax Tip 2021-87 June 17 2021. Being an employer comes with its own compliance requirements and challenges in normal day-to-day operations.

Unemployment benefits at tax time. Pandemic-era relief laws have changed this temporarily. As of March 11 2021 under the American Rescue Plan the first 10200 in unemployment benefits collected in the.

Anyone who receives it must pay taxes on that money. 2 on up to 3000 of taxable income.

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

Covid Bill Waives Taxes On 20 400 Of Unemployment Pay For Couples

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Covid 19 And Your Taxes Our Experts Answer All Your Questions

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Stimulus Payments Start To Arrive The Latest On The Coronavirus Relief Bill The New York Times

The Unemployment Impacts Of Covid 19 Lessons From The Great Recession

Stimulus Faq Checks Unemployment Layoffs And More The New York Times

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

The Case For Forgiving Taxes On Pandemic Unemployment Aid

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

2021 Unemployment Benefits Taxable On Federal Returns King5 Com

Covid Bill Changes Tax Rules Midstream How To File An Amended Return

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

What To Know About Covid 19 And Your Taxes 2022 Turbotax Canada Tips

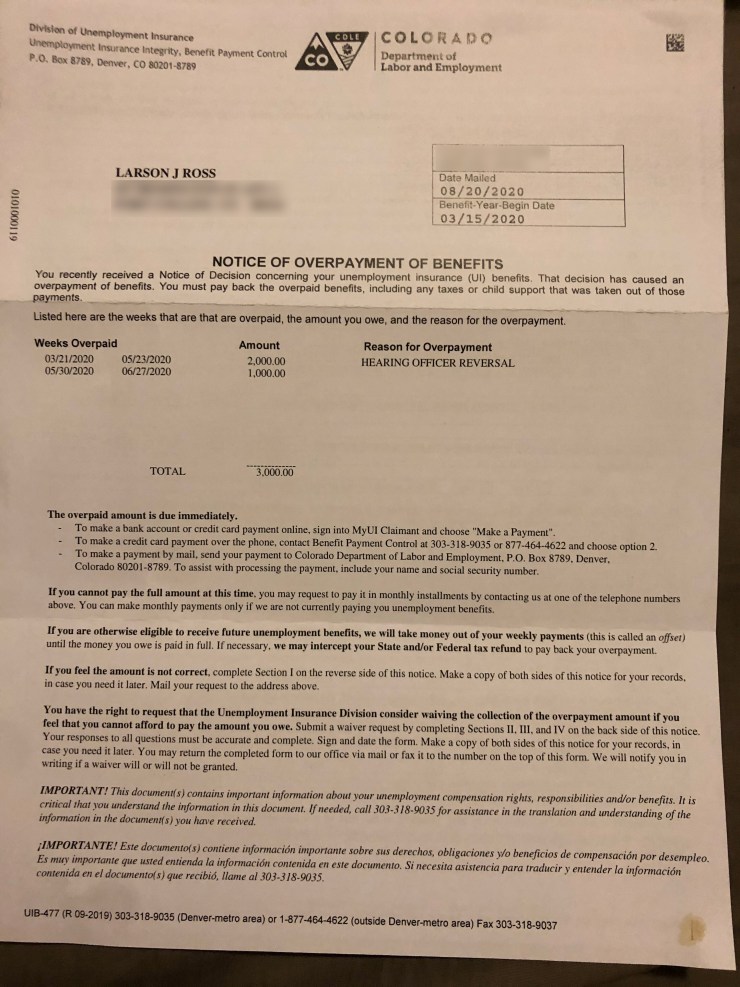

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace